A trade union reports that over 10,000 former retained firefighters across the United Kingdom may be missing out on pension payments.

Following recent legal rulings, these payments could range from several thousand to over £100,000.

The Fire and Rescue Services Association (FRSA) is urging potentially eligible individuals to contact their former employers to inquire about their eligibility and receive assistance with the claim process.

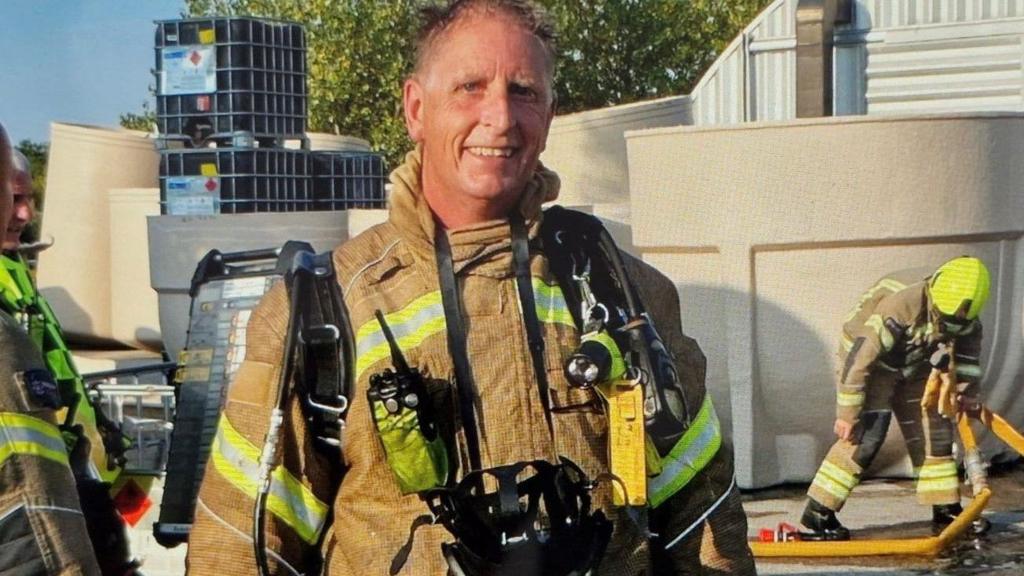

Retained, or on-call, firefighters typically serve in more rural areas, responding to emergency calls while maintaining regular employment.

Historically, these firefighters were not entitled to pensions. However, landmark legal decisions in recent years have changed this, granting them pension eligibility.

Individuals who served as retained firefighters between April 2000 and April 2006, dates connected to the aforementioned rulings, may now qualify for pension benefits, potentially covering their entire career, not just those six years.

Qualifying individuals must “buy back” (pay for) the pension contributions they would have made, with this cost potentially offset against their final payment.

The total payment amount will vary based on factors such as length of service, station activity level, and attained rank.

Peter Duncombe, a 35-year veteran retained firefighter in Buckinghamshire, qualified for a lump sum of approximately £10,000, along with ongoing monthly payments of around £180.

“This extra pension… is a great bonus toward the household,” he stated.

“Especially with the current issues with the cost of living increases, fuel rises and electricity going up. It’s just excellent really.

“The lump sum, which was a great bonus, we’re actually going to use some of that for a once-in-a-lifetime holiday… and the remainder will go back into the kitty for maybe another holiday in another year.”

The FRSA estimates that approximately 16,000 individuals have already initiated claims.

Many have received substantial lump sum payments and are now receiving ongoing monthly payments.

However, the union believes at least 10,000 more eligible individuals have yet to file a claim.

The FRSA is urging these individuals to contact their former employers to learn how to file a claim or to seek assistance and advice from the union through its website.

A spokesperson for the Ministry of Housing, Communities & Local Government stated, “It’s essential our firefighters get the pensions they have earned as quickly as possible.”

“Fire and rescue authorities are responsible for the administration of the pensions, and the government is supporting them to address issues raised by firefighters.”

A Local Government Association spokesperson added, “Some individuals have service that goes back as far as the 1960s and Fire and Rescue Authorities have been working tirelessly in trying to trace some individuals, to ensure that they do not miss out on this opportunity.”

Paul Jarvis, who served as a retained firefighter in Devon and Cornwall for nearly 30 years, qualified for a lump sum payment of around £30,000 and ongoing monthly payments of nearly £200.

“This lump sum payment will improve my expectations and will mean that I can afford to retire nearly straightaway,” he stated.

“Then, going forward, it will boost my state pension… as well as giving me an extra monthly payment which, in these times, is a very, very useful payment.”

A spokesperson for the National Fire Chiefs Council, representing fire and rescue services, emphasized the “critical role” of on-call firefighters in the UK’s emergency response and strongly encouraged potentially eligible individuals to contact their pensions administrator.

Future pensioners are set to be worse off than today’s with four-in-10 not saving enough for retirement, says the DWP.

A retired NHS worker is still waiting for her NHS pension to be paid leading her to incur debts.

President Milei and his vice-president trade barbs after a controversial pension hike is approved.

The official forecaster warns public finances are in a “relatively vulnerable position” due U-turns.

The triple lock guarantees that the state pension is not overtaken by inflation or wage increases.