“`html

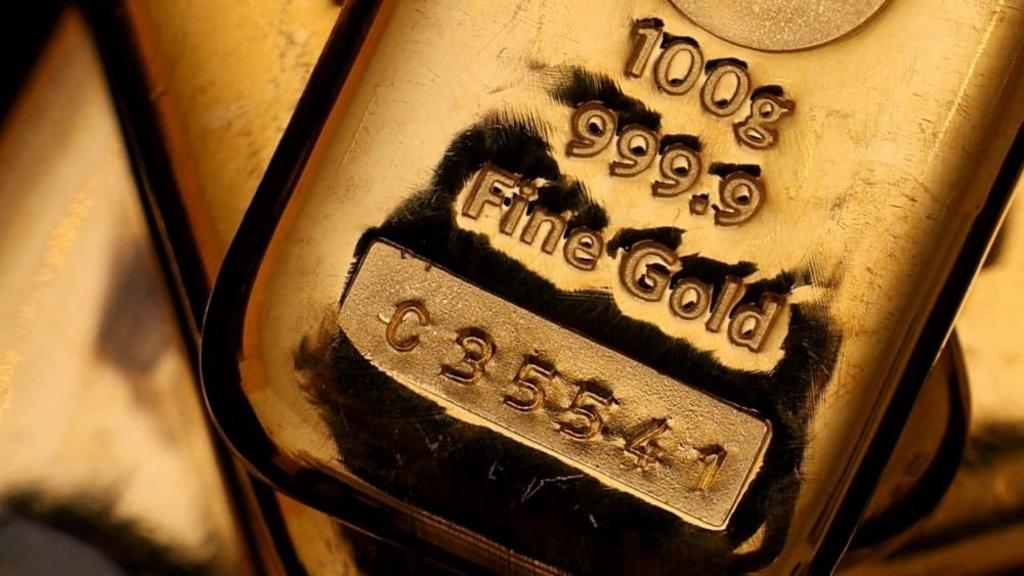

Gold prices have surged past $5,000 (£3,659) per ounce for the first time, continuing a significant rally that saw the precious metal increase by over 60% in 2025.

This milestone arrives amid escalating tensions between the United States and NATO concerning Greenland, exacerbating existing concerns regarding financial and geopolitical stability.

Furthermore, the trade policies of U.S. President Donald Trump have contributed to market apprehension. On Saturday, he threatened to impose a 100% tariff on Canada should it establish a trade agreement with China.

Gold and other precious metals are widely regarded as safe-haven assets, attracting investors during periods of uncertainty.

The demand for gold has also been fueled by various factors, including higher-than-average inflation rates, a weakened U.S. dollar, substantial purchasing activity by central banks globally, and expectations of further interest rate reductions by the U.S. Federal Reserve this year.

Ongoing conflicts in Ukraine and Gaza, alongside the U.S. seizure of Venezuelan President Nicolás Maduro, have further contributed to the upward pressure on gold prices.

On Friday, silver also reached a record high, surpassing $100 per ounce for the first time, building upon its near 150% increase from the previous year.

Donald Trump’s proposal to implement import taxes related to Greenland has directed investor interest towards precious metals.

Investors are speculating that this action may unlock opportunities to exploit the nation’s oil reserves.

The price of gold experienced a surge of over 60% this year, achieving an unprecedented high of over $4,549.

Investors are increasingly turning to precious metals amid geopolitical tensions and anticipations of additional U.S. interest rate cuts.

The price of the precious metal has surpassed $60 an ounce, marking an all-time high.

“`