Go to the comments section below to share your perspective on the increasing affordability of electric vehicles.

Known as the Seagull in China, this sleek, angular vehicle boasts bright, downward-slanting headlights, giving it a somewhat mischievous appearance.

This compact city car, already a popular choice in China since its 2023 release, is poised to make a significant impact. Recently launched in Europe as the Dolphin Surf (reflecting a perceived difference in market preferences), it’s set to arrive in the UK this week.

With an anticipated price tag of around £18,000, it represents a remarkably affordable electric vehicle option for Western markets.

While not the absolute cheapest EV available – the Dacia Spring and Leapmotor T03 hold that distinction – the Dolphin Surf’s arrival has major established brands concerned.

The manufacturer, BYD, is a rapidly expanding force. Having surpassed Tesla in 2024 to become the world’s leading electric vehicle producer, its aggressive expansion into European markets has begun to yield significant results.

“Our aim is to secure the top spot in the British market within a decade,” states Steve Beattie, BYD UK’s sales and marketing director.

BYD’s success reflects a broader trend of Chinese companies making significant inroads into the global automotive industry, prompting responses from the US and EU.

This means lesser-known brands like Nio, Xpeng, Zeekr, and Omoda have the potential to become as recognizable as Ford or Volkswagen. They join established brands like MG, Volvo, and Lotus, already under Chinese ownership.

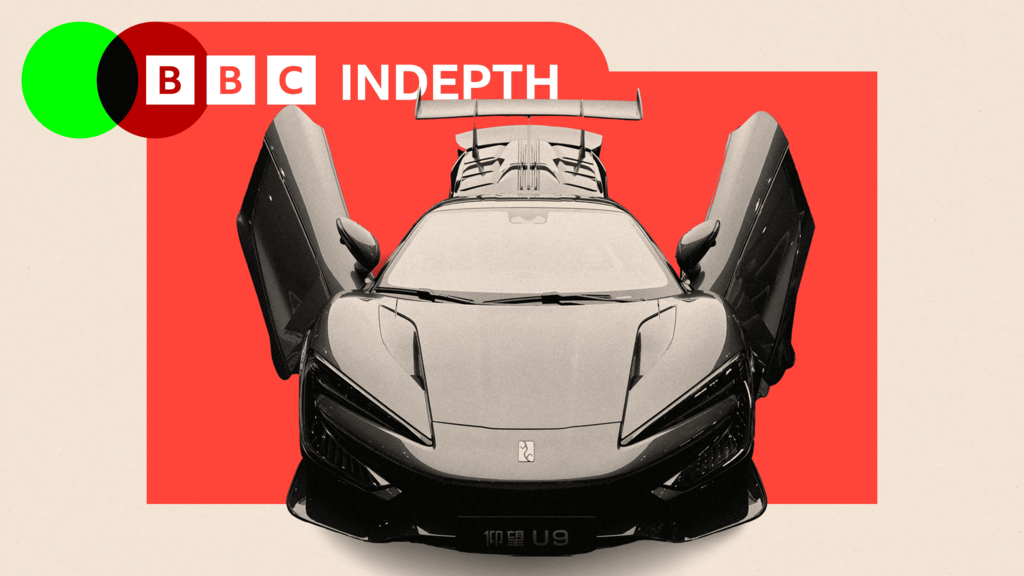

The range of offerings is substantial, from compact vehicles like the Dolphin Surf to high-performance models such as BYD’s Yangwang U9 supercar.

“Chinese brands are making substantial gains in the European market,” observes David Bailey, professor of business and economics at Birmingham Business School.

In 2024, global sales of battery and plug-in hybrid vehicles reached 17 million units, with China accounting for 11 million. Chinese brands secured 10% of global EV and plug-in hybrid sales outside of China, a figure projected to rise, according to Rho Motion.

This expansion offers consumers increased access to high-quality, affordable electric cars. However, geopolitical tensions and concerns about potential security risks related to hacking and data privacy remain.

“China enjoys a considerable cost advantage due to economies of scale and advanced battery technology. European manufacturers have fallen behind significantly,” cautions Mr. Bailey.

“Unless they rapidly catch up, they risk being overtaken.”

China’s automotive industry has seen rapid growth since its 2001 entry into the World Trade Organization. This accelerated in 2015 with the introduction of the “Made in China 2025” initiative, a ten-year plan to establish the country as a leader in high-tech industries, including EVs. This plan, heavily criticized internationally for alleged forced technology transfers and intellectual property theft (claims denied by the Chinese government), spurred significant growth for companies like BYD and contributed to the rise of SAIC and Geely as major players in the EV market.

“The overall quality of Chinese cars is exceptionally high,” comments Dan Caesar, chief executive of Electric Vehicles UK.

“China has mastered automotive manufacturing remarkably quickly.”

However, intense competition in the saturated Chinese market has driven manufacturers to seek international expansion.

While expansion into East Asia and South America occurred earlier, the European market presented a greater challenge until government policies to phase out petrol and diesel vehicles opened opportunities for new entrants.

“Chinese brands have recognized an opportunity to gain a foothold,” explains Oliver Lowe, UK product manager for Omoda and Jaecoo, sub-brands of Chery.

Lower labor costs, government subsidies, and a robust supply chain provide competitive advantages, according to rivals. A 2023 UBS report estimated BYD’s production costs to be 25% lower than Western competitors.

Chinese firms counter that their competitiveness stems from operating within the world’s most challenging market. Xpeng’s vice chairman, Brian Gu, stated at the 2024 Paris Motor Show that their success is due to intense competition.

Concerns about the potential impact of Chinese EV imports on established manufacturers reached a peak in 2024. The Alliance for American Manufacturing warned of a potential “extinction-level event” for the US industry, while the European Commission President suggested that Chinese government subsidies were distorting the European market.

In response, the Biden administration increased import tariffs on Chinese EVs from 25% to 100%, effectively barring their sale in the US. This move was condemned by Beijing as protectionism.

Similarly, the EU imposed additional tariffs of up to 35.3% on Chinese-made EVs in October 2024. The UK, however, did not implement similar measures.

Matthias Schmidt, founder of Schmidt Automotive Research, suggests that EU tariffs have hindered Chinese market share.

“The market was open in 2024… but Chinese manufacturers failed to capitalize fully. The tariffs now prevent them from passing cost advantages on to European consumers.”

European manufacturers are actively developing their own affordable electric vehicles. Renault’s Douai factory, modernized with advanced automation and a nearby battery gigafactory, exemplifies this effort, emphasizing cost efficiency and leveraging established brand recognition.

The Renault 5 E-tech, a modern EV drawing inspiration from its popular predecessor, highlights the integration of heritage into this new era.

However, independent of market competition, security concerns persist. The internet connectivity of modern vehicles raises concerns about potential hacking, spyware, surveillance, and remote vehicle disablement.

Reports suggest restrictions on EV usage within certain UK government circles, fueled by concerns about potential Chinese technology control.

Beijing consistently denies espionage allegations.

A spokesperson for the Chinese embassy in London dismisses recent allegations as “entirely unfounded and absurd,” asserting China’s commitment to secure global supply chains and compliance with local regulations, and stating a lack of credible evidence to support security threat claims.

Joseph Jarnecki, a researcher at The Royal United Services Institute, suggests risk mitigation strategies. He argues that while Chinese manufacturers must comply with Chinese law, they also seek international growth and are unlikely to risk their reputation through security breaches. He also notes the Chinese government’s interest in economic growth.

However, the increasing integration of Chinese technology into the UK economy, particularly crucial for achieving climate goals, necessitates robust cybersecurity oversight.

The presence of Chinese-powered electric vehicles is undeniable.

“Even vehicles manufactured in Germany or elsewhere likely incorporate numerous Chinese components,” Dan Caesar points out.

“We readily use smartphones and other products from China, the US, and Korea without significant concern. Some of the fear-mongering surrounding Chinese capabilities needs to be addressed. China will be a major player in the future.”

Top image credit: Reuters

Fresh talks aimed at resolving the trade war between the world’s two largest economies are underway.

Driverless lorries are now operating across China – but public concern about these vehicles persists.

At the coroner’s court in County Clare, a French tourist describes seeing the 12-year-old boy from China fall over the edge.

The leaders of the US and China agree to further talks aimed at reaching a deal amid an ongoing trade war.

An 11-year-old girl in Henan, China, rescued her baby sister from a runaway electric mini cabin scooter.