At OpenAI’s DevDay this week, CEO Sam Altman distinguished himself by engaging with reporters, a practice increasingly rare among American tech executives.

“I know it’s tempting to write the bubble story,” Altman conceded, surrounded by his leadership team. “In fact, there are many parts of AI that I think are kind of bubbly right now.”

The debate regarding the potential overvaluation of AI companies has intensified within Silicon Valley.

Skeptics are privately—and increasingly publicly—questioning whether the rapid appreciation in value of AI technology firms is, at least partially, attributable to what they term “financial engineering.”

In essence, concerns are mounting that these companies may be overvalued.

Altman acknowledged the likelihood of investors making imprudent decisions and ill-conceived startups securing exorbitant funding.

However, he asserted that “there’s something real happening here” with OpenAI.

This sentiment is not universally shared.

Recent warnings about a potential AI bubble have emanated from institutions such as the Bank of England, the International Monetary Fund, and JP Morgan CEO Jamie Dimon, who stated to the BBC that “the level of uncertainty should be higher in most people’s minds.”

Even within Silicon Valley, anxieties are escalating.

During a panel discussion at the Computer History Museum, early AI entrepreneur Jerry Kaplan, a veteran of four previous bubbles, expressed his heightened concerns given the substantial financial stakes involved, exceeding those of the dot-com era.

“When [the bubble] breaks, it’s going to be really bad, and not just for people in AI,” he cautioned.

“It’s going to drag down the rest of the economy.”

Conversely, Prof. Anat Admati of the Stanford Graduate School of Business suggests that accurately predicting a bubble is a challenging endeavor.

“It is very hard to time a bubble,” Prof. Admati stated. “And you can’t say with certainty you were in one until after the bubble has burst.”

Nevertheless, the data raises concerns for many.

AI-related enterprises have accounted for 80% of the remarkable gains in the American stock market this year. Gartner projects that global spending on AI will reach $1.5 trillion before the end of 2025.

OpenAI, which propelled AI into the mainstream with ChatGPT in 2022, is at the center of the network of deals under scrutiny.

For instance, it recently entered into a $100 billion agreement with chipmaker Nvidia, the world’s most valuable publicly traded company.

This expands Nvidia’s existing investment in Altman’s company, with OpenAI expected to construct data centers powered by Nvidia’s advanced chips.

Furthermore, OpenAI announced plans to purchase billions of dollars worth of AI development equipment from Nvidia competitor AMD, potentially making it one of AMD’s largest shareholders.

It is important to note that OpenAI remains a private company, albeit one recently valued at $500 billion.

Tech giant Microsoft is also heavily invested, and cloud computing leader Oracle maintains a $300 billion agreement with OpenAI.

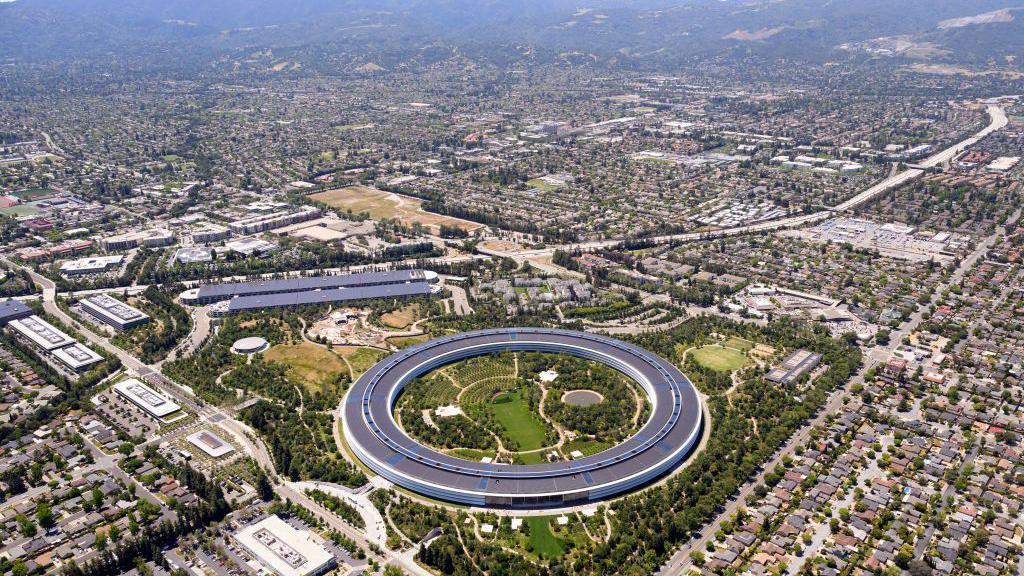

OpenAI’s Stargate project in Abilene, Texas, supported by Oracle and SoftBank, and announced at the White House during President Trump’s first week in office, continues to expand.

Nvidia also holds a stake in AI startup CoreWeave, a provider of infrastructure to OpenAI.

As these complex financing arrangements become increasingly prevalent, experts in Silicon Valley suggest they may be obscuring perceptions of genuine AI demand.

Some are openly labeling these deals as “circular financing” or “vendor financing,” wherein a company invests in or provides loans to its own customers to facilitate continued purchases.

“Yes, the investment loans are unprecedented,” Altman acknowledged.

However, he added, “it’s also unprecedented for companies to be growing revenue this fast.”

While OpenAI’s revenue is growing rapidly, it has yet to achieve profitability.

It is noteworthy that individuals consulted have repeatedly drawn parallels to Nortel, the Canadian telecom equipment manufacturer that engaged in extensive borrowing to finance customer deals, thereby artificially inflating demand for its products.

Nvidia’s Jensen Huang defended his company’s agreement with OpenAI on CNBC, asserting that OpenAI is not obligated to use the invested funds to purchase Nvidia’s technology.

“They can use it to do anything they like,” Huang stated.

“There’s no exclusivities. Our primary goal is just really to support them and help them grow – and grow the ecosystem.”

Kaplan identifies potential warning signs for the AI sector and the broader economy.

He suggests that during periods of exuberance, companies often announce major initiatives and product plans without securing the necessary capital.

Meanwhile, retail investors eagerly seek to participate in startup ventures.

The surge in AMD stock this week may indicate investors attempting to capitalize on the ChatGPT phenomenon. Concurrently, physical infrastructure is being developed to meet the escalating demand for AI development.

“We’re creating a new man-made ecological disaster: enormous data centres in remote places like deserts, that will be rusting away and leaching bad things into the environment, with no one left to hold accountable because the builders and investors will be long gone,” Kaplan warned.

Even in the event of a bubble, there is optimism within Silicon Valley that current investments will not be entirely unproductive.

“The thing that comforts me is that the internet was built on the ashes of the over-investment into the telecom infrastructure of yesterday,” said Jeff Boudier, who builds products at the AI community hub Hugging Face.

“If there is overinvestment into infrastructure for AI workloads, there may be financial risks tied to it,” he acknowledged.

“But it’s going to enable lots of great new products and experiences including ones we’re not thinking about today.”

Many remain optimistic about AI’s transformative potential.

The key question is whether the financial resources required to support the ambitions of leading companies in the sector may be dwindling.

“Nvidia looks like the last lender or investor,” stated Rihard Jarc, founder of the UncoverAlpha newsletter.

“Who else has the capacity right now to invest $100 billion in another company?”

Sign up for our Tech Decoded newsletter to follow the world’s top tech stories and trends. Outside the UK? Sign up here.

Correspondent Angus Crawford has been following the progress of this much-heralded safety law for the last 12 months and explains whether it lives up to the hype

The proposed legislation would have imposed some of the first US regulations on artificial intelligence.

The Trump campaign has seen upticks in fundraising during pivotal moments of his legal battles.

A clash with the actor has echoes of the macho tech giants of the past, says Zoe Kleinman.

The dishevelled former wunderkind fooled Silicon Valley and stole billions from customers, a court found.